Compliance Solutions for

Asset Management and Hedge Funds

Regulatory pressures for Buy Side are increasing all the time. But it’s likely your compliance resources aren’t growing at the same pace. Is your firm managing large volumes of assets without adequate supervisory and surveillance coverage? Are outdated legacy surveillance point solutions driving up your compliance costs, overwhelming your compliance analysts with high false positive rates, and making it harder to identify and weed out conduct risk? It’s time for a change.

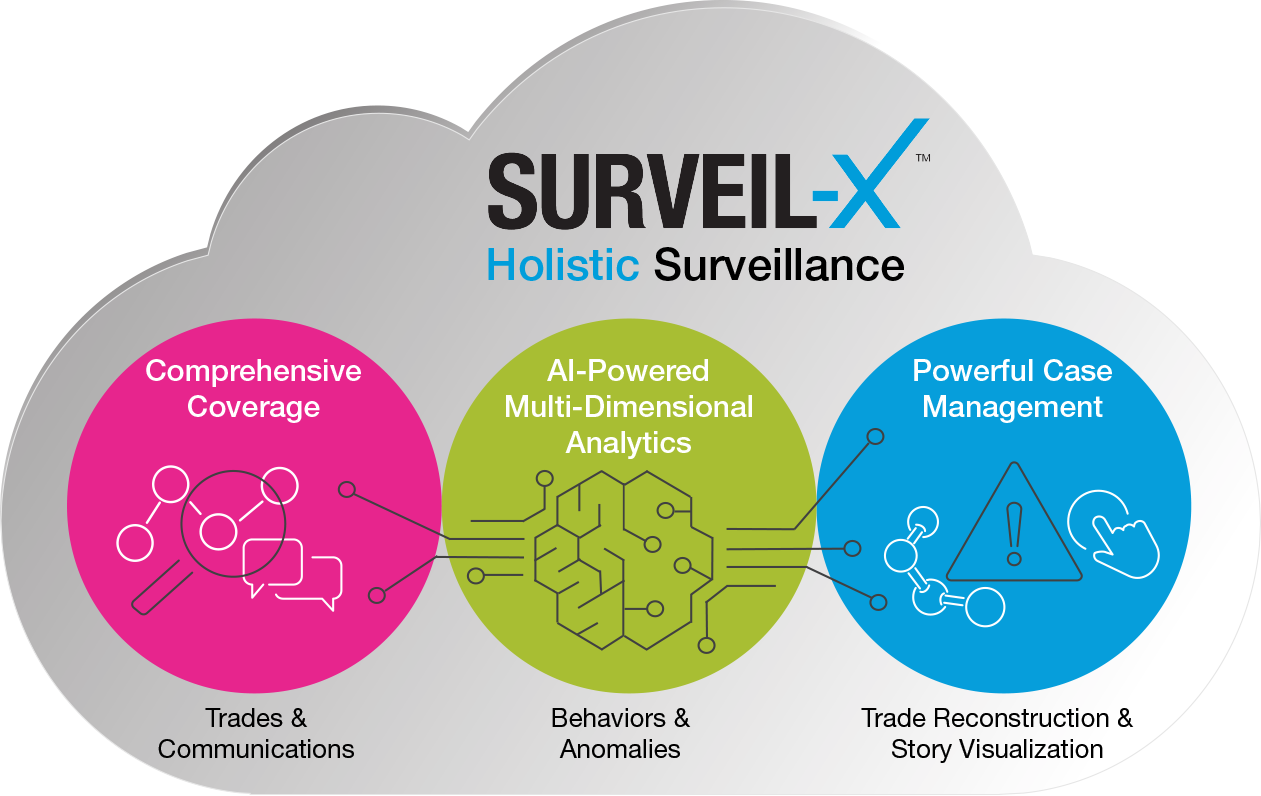

SURVEIL-X Holistic Surveillance

Take your Trade-Related Surveillance to a Whole New Level

Multi-Dimensional Analytics Using all Trade-Related Data

Uses Natural Language Processing (NLP) to process all Communications

Events Reconstructed to Demonstrate True Intent

Discovers Previously Unknown Risk

Cloud Agility and Cost Savings

Provides Full Global Regulatory Coverage

The SURVEIL-X Advantages for Buy-Side

Complete Surveillance Coverage

Complete Surveillance Coverage

- Analyzes All Data Sources

- Surveils All Communications

- Detects Known and Unknown Risk

- One Solution for All Asset Classes

- Cross-Market/Cross-Product Manipulation

- Comprehensive Regulatory Coverage

AI-Powered Analytic Techniques

AI-Powered Analytic Techniques

- Multi-Dimensional Analytics

- Natural Language Understanding

- Out-of-the-Box Risk Detection Models for Buy-Side

- Advanced Anomaly Detection

Cloud Platform-as-a-Service

Cloud Platform-as-a-Service

- Faster Deployment

- Reduced Costs for Infrastructure and Maintenance

- Hassle-Free Upgrades

- Seamless Scalability

- Improved Resiliency and Security

- Streamlined Innovation

Powerful Case Management

Powerful Case Management

- One Place to Work

- Gaining Efficiency through Automation

Is Outdated Surveillance Technology Putting Your Firm at Risk?

Read this complimentary eBook and learn about 4 innovative ways that SURVEIL-X can help your firm overcome surveillance challenges, while confidently complying with regulations, and staying a step ahead of risk.