Introduction

In today’s rapidly evolving financial landscape, combating financial crime requires a unified approach that bridges the gaps between data, technology and operational processes. Too often, these elements operate in silos—leading to inefficiencies, delayed responses and missed threats. Aligning these elements is essential to create a cohesive and responsive financial crime framework. When these components are integrated effectively, financial institutions (FI) can unlock deeper insights, automate detection and investigation workflows, and ensure a consistent, risk-based approach for informed decision-making. This article explores the strategic importance of this alignment and its role in strengthening the financial crime function’s within FIs ability to prevent, detect and respond to increasingly sophisticated threats.

Data Alignment

For FIs, having the right data—data that is meaningful and aligned with operational functions—can be a decisive factor in achieving market success.

Data Alignment is a foundational element for any organization aiming to become data and AI-driven. It is the process of preparing and structuring data so that it is consistent, accurate and aids in decision making. When data is properly aligned with business objectives, it enables organizations to uncover trends, anticipate customer needs and deliver personalized services. This alignment transforms raw data into actionable insights, fostering innovation and strategic decision-making.

Real-World Examples of Aligned Data in Financial Services

Fraud Detection and Prevention

By aligning transaction records, customer behavior patterns, time and geolocation data, banks can detect suspicious activities in real time. This proactive approach helps prevent fraud, reduce financial losses and maintain customer trust.

Credit Risk Assessment

FIs align data from credit histories, income documentation and spending behavior to evaluate loan applications. This ensures more accurate risk profiling and supports responsible lending practices.

Personalized Banking Services

Aligned customer data—such as transaction history, financial goals and life events—enables banks to offer tailored financial products like customized savings plans, credit options or investment advice, enhancing customer engagement and loyalty.

Detecting Fake Claims Processing in Insurance

Insurance providers align policy details, customer profiles and incident documentation to streamline claims processing. This reduces turnaround time, minimizes manual errors and improves the overall policyholder experience.

Regulatory Compliance and Reporting

FIs align internal financial data with regulatory requirements to ensure accurate and timely reporting. This alignment supports compliance with frameworks such as Basel III or IFRS, reducing the risk of penalties and enhancing transparency.

How to Achieve Data Alignment:

In today’s data-driven business landscape, operational excellence and effectiveness hinge on the ability to harness high-quality, well-aligned data across all functions. Yet, many organizations struggle with fragmented data collection practices, where each business unit captures customer data independently, often for its own specific needs. This siloed approach can lead to inconsistencies, inefficiencies and missed opportunities.

To truly unlock the power of data, businesses must focus on data alignment—ensuring that data captured across departments is accurate, consistent and usable enterprise-wide. Here’s how organizations can achieve this:

- Understand the Importance of Unified Data

Every customer interaction generates valuable data. Sales, marketing, customer service, compliance and risk management teams all collect and use this data differently. However, without a unified approach to storing and managing it, the organization risks creating silos that hinder collaboration and decision-making.

Aligned data enables:

- Seamless cross-functional collaboration

- Accurate reporting and analytics

- Enhanced customer experiences

- Improved regulatory compliance

- Empower Frontline Teams with Data Awareness

Customer-facing teams play a pivotal role in data quality. They are often the first point of contact and the primary source of data entry. Therefore, it’s essential to:

- Train and sensitize staff on the importance of accurate data capture

- Implement validation checks at the point of entry to reduce errors

- Foster a data-first culture where senior management and employees alike understand the downstream impact of their actions in managing data

- Conduct a Comprehensive Data Mapping Exercise

One of the most effective ways to achieve data alignment is through a data mapping exercise. This involves identifying what data is collected, where it originates, how it flows through systems and how it is used by different departments.

Key Steps:

- Identify critical data points: Focus on customer-centric data that is used across multiple functions

- Map data flows: Understand how data moves from customer-facing applications to backend systems

- Detect and address gaps: Look for inconsistencies, redundancies or missing data that could impact downstream processes

For example, in a banking environment,the compliance team relies on accurate customer data for Know Your Customer (KYC), Customer Due Diligence (CDD) and risk assessments. The fraud detection and the anti-money laundering systems then use transaction data to identify suspicious activities. If the initial data captured during customer onboarding is incomplete or inaccurate, it can compromise the effectiveness of these critical functions.

Actionable Tip:

Train the customer service executives on the importance of accurate data capture and ensure backend systems are designed to support seamless data flow.

- Standardize Data Collection Practices

Standardization ensures that data is consistent, comparable and usable across geographies and business units.

Why it’s important:

In multinational organizations, data formats (such as dates, currencies or addresses) can vary significantly. Without standardization, it becomes difficult to aggregate and analyze data at a regional or global level.

Example:

To generate performance metrics across countries, data must be in a uniform format. This enables faster, more accurate decision-making.

Best practices:

- Define and enforce data standards across all systems

- Use metadata and tagging for context

- Align with international data standards where applicable

- Use centralized data repositories or data lakes to store and manage information

- Leverage data governance frameworks to enforce policies and maintain accountability

- Leverage Technology for Data Integration

Modern data integration tools and platforms can help bridge the gap between disparate systems. By automating data synchronization and cleansing, businesses can:

- Reduce manual errors

- Improve data timeliness

- Enable real-time insights

- Perform Regular Data Audits

Data audits are essential for identifying discrepancies between front-end data capture and backend usage.

Who should be involved:

While customer-facing teams play a role, IT systems engineers and data consultants are equally critical. They must ensure that data fields are correctly defined, validation rules are in place and systems are aligned.

Audit goals:

- Detect mismatches between systems

- Validate data accuracy and completeness

- Ensure compliance with data governance policies

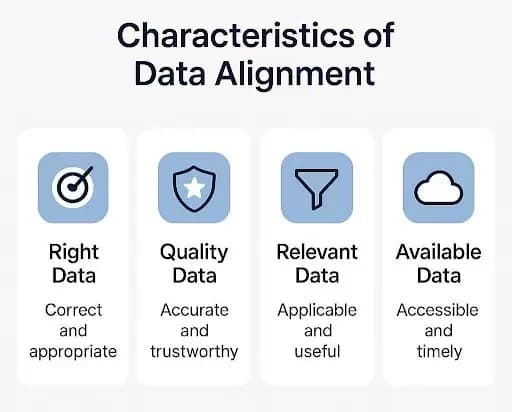

Characteristics of Data Alignment:

Right Data

Right data refers to the accurate and intended information that aligns with the business objective. It ensures that the data collected is relevant to the context in which it will be used. For example, capturing a customer’s financial history is essential for credit risk assessment but irrelevant for marketing preferences. Right data supports informed decision-making and reduces noise in analytics.

Quality Data

Quality data is clean, consistent and free from errors or duplications. It is validated at the point of entry and maintained throughout its lifecycle. High-quality data enhances trust in reporting, improves operational efficiency and ensures compliance with regulatory standards. It includes completeness, accuracy, timeliness and integrity.

Relevant Data

Relevant data is information that directly supports the goals of a specific business function or process. It avoids unnecessary clutter and focuses on what’s needed to drive insights or actions. For instance, demographic data may be relevant for marketing segmentation but not for fraud detection. Relevance ensures that data serves a clear purpose.

Available Data

Available data means that the required information is accessible when and where it’s needed. It involves proper storage, indexing and integration across systems. Availability supports real-time decision-making, enhances responsiveness and reduces delays in operations. It also includes ensuring data is not siloed and can be shared securely across departments.

Benefits of Data Alignment

Effective data alignment is foundational to a robust financial crime strategy. When data is harmonized across systems and functions, it unlocks several critical advantages:

1. Enhanced Detection of Suspicious Behavior

Unified and high-quality data significantly improves the accuracy and timeliness of detecting money laundering and fraud. For example, aligning customer onboarding data with transaction monitoring systems enables better identification of discrepancies in declared income versus actual transaction volumes. Similarly, linking internal data with external sources—such as sanctions lists, adverse media and beneficial ownership registries—enhances the ability to flag high-risk entities and networks. This holistic view supports more accurate risk scoring and reduces false negatives.

2. Operational Efficiency and Cost Reduction

Aligned data reduces duplication, manual reconciliation and fragmented workflows. For instance, when case management systems are fed with consistent and structured data from alerting engines, investigators spend less time gathering context and more time on analysis. This streamlining leads to faster investigations, fewer false positives and optimized resource allocation—ultimately lowering operational costs and improving productivity across financial crime teams.

3. Improved Regulatory Compliance:

Consistent and well-governed data enables institutions to respond more effectively to evolving regulatory requirements. For example, accurate and traceable data lineage supports audit trails for Suspicious Activity Reports (SARs), KYC reviews and Enhanced Due Diligence (EDD) processes. It also facilitates smoother regulatory reporting and reduces the risk of fines due to incomplete or inaccurate submissions. Moreover, aligned data helps institutions adapt quickly to new mandates such as the FATF Travel Rule or evolving AML directives.

Conclusion

Operational excellence starts with aligned, high-quality data. Achieving operational excellence is not just about having information—it’s about having the right information, aligned across the organization. By investing in data mapping, empowering teams, standardizing practices and leveraging technology, businesses can transform fragmented data into a strategic asset that drives efficiency, compliance and growth.

Achieving data alignment is not a one-time project—it’s an ongoing commitment to quality, consistency and collaboration. It is one of the most vital components of Data Governance.

How Actimize Professional Services can help

NICE Actimize offers significant expertise in providing tailor-made approaches to adopting Data Governance, covering multi-dimensional aspects such as:

- Data privacy norms

- Data lineage

- Data layering

- Storage and consumption strategies

- Establishing data as the single souce of truth across the organization

Scenario: Strengthening AML Investigations through Tailored Data Governance

A large FI is facing challenges in its Anti-Money Laundering (AML) operations. Investigators are struggling with fragmented customer data, inconsistent transaction records and delays in accessing relevant information. These inefficiencies are leading to missed red flags, prolonged case resolution times and increased regulatory scrutiny.

To address this, the institution partners with NICE Actimize to implement a tailor-made data governance framework. The approach includes:

- Data Privacy Norms: Ensuring sensitive customer and transaction data is handled in compliance with global regulations like GDPR and local data protection laws, while still enabling investigative access under controlled conditions.

- Data Lineage: Establishing clear traceability of data from source systems to AML dashboards, allowing investigators to validate the origin and transformation of data used in decision-making.

- Data Layering: Creating logical data layers—raw, curated and analytical—so that AML systems consume only the most relevant and quality-assured data, reducing noise and false positives.

- Storage and Consumption Strategies: Optimizing data storage for high-volume transactional data and enabling real-time access for monitoring systems, while archiving historical data for audit and compliance purposes.

- Single Source of Truth: Integrating disparate data sources into a unified data platform, enabling investigators to view a consolidated customer risk profile, transactional behavior and historical alerts in one place.

As a result, the institution experiences a marked improvement in detection accuracy, faster case closures and enhanced audit readiness. Regulatory feedback also improves due to the transparency and consistency of data handling.

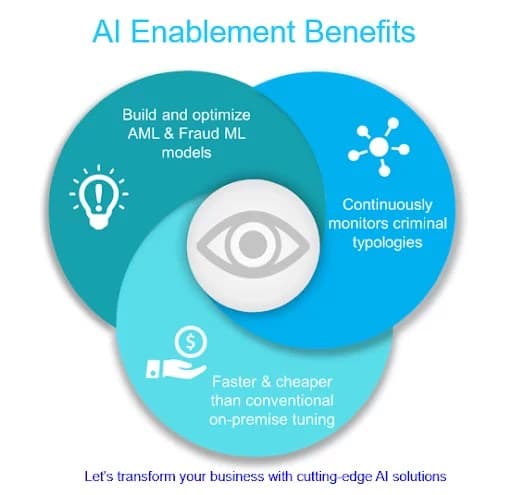

When data is properly aligned across an FI, AI projects—especially those in the financial crime domain—can deliver significantly greater value and operational transparency. Let us take a look at the AI-Enablement service of NICE Actimize.

AI-Enablement Services

Our AI-enablement services are powered by a team of 55+ experts in financial crime, data science and AI, focused on delivering innovation and measurable outcomes.

We deliver:

- Regular advisory sessions (monthly/quarterly) offering performance insights, model tuning and industry best practices

- Streamlined deployment of Actimize AI solutions, ensuring clarity and ease of use for business and compliance teams

- Comprehensive support for advanced Actimize AI capabilities, including Generative AI (GenAI) and Agentic AI.

- A trusted advisor on the AI adoption journey, guiding you every step of the way.

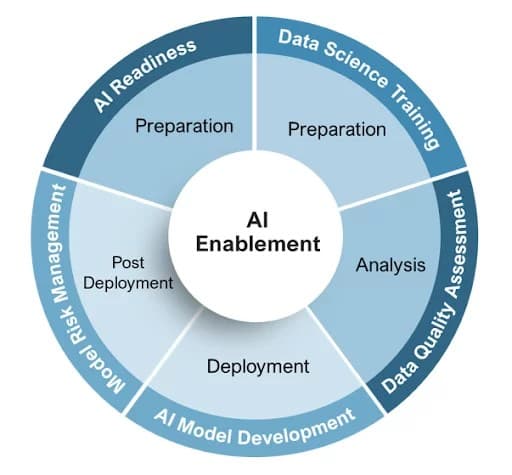

Actimize AI Services Overview

- Actimize helps clients define their AI strategy, enhance detection accuracy and streamline investigations.

- We assess data quality, evaluate its impact on AI outcomes and support Model Risk Management compliance.

- Our services span the full AI lifecycle—from readiness and analysis to deployment and post-production optimization.

Point of Contact:

If it interests you to explore the Actimize services and meet our team, please reach out to the author, Harsha Koparde, through Harsha.Koparde@niceactimize.com