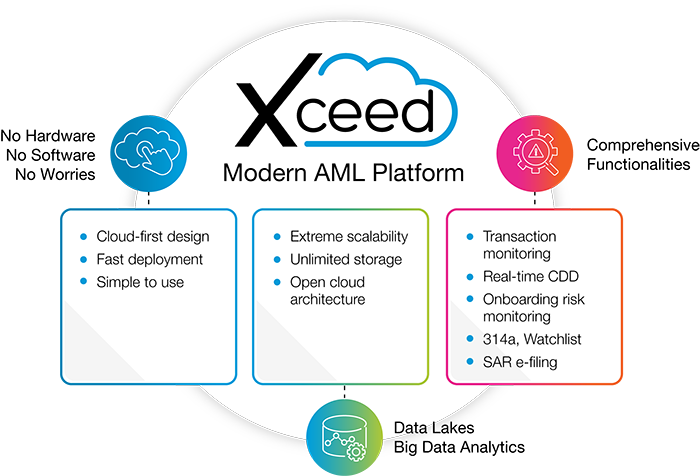

Xceed Anti-Money Laundering Solutions

Criminals have weaponized AI and Machine Learning to breach conventional AML detection tools. As such, financial services organizations (FSOs), casinos and money service businesses should not look at financial crime from a solely regulatory perspective. With the rise of quicker payments and more sophisticated money laundering schemes, there are sizable challenges in detecting and preventing money laundering targeted at their clients and themselves. In addition, the current ever-changing environment creates the need for adding more rules and the need to change thresholds of old rules.

Xceed AML Evidence Lake™ Features

- Detect and investigate Money Laundering scenarios with a graph-based link analysis.

- Increase AML investigation efficiency with point and click evidence exploration.

- Save time and money self-configuring your own smart rules.

- Multi-year evidence retention in a single financial crimes platform.

Xceed AML Evidence Lake™ Benefits

- Multi-Channel Link Analysis: Uses graph database to gives a 360 view of all the data connected to the subject to further help analysts with the investigation.

- Instant Validation with Simulation: Be at ease when making any changes to the Smart Rules as the changes can be validated immediately with an Alert Simulation showing the Manager what alert would have been generated in a given time frame if the changes were made in the past.

- Monitors All Types of Watchlists: Upload any type of watchlist into AML Evidence Lake and it will be scanned across your customer base and transactions counterparty, generating alerts for analysts to work. This can include 314A or any custom list provided.

- One Click FinCEN VPN E-filing: All the data in the alert and case will automatically be pre-populated in the SAR and CTR forms to save analysts time from entering the field one by one and prevent potential human error. Additionally, extra validation is added so that no SARs or CTRs will be filed to FinCEN with warnings or fatal errors, giving managers and analysts peace of mind.

Xceed AML Evidence Lake™ CDD

Decrease and de-risk your onboarding time using our customizable, flexible KYC/CDD rules-based system, while remaining in compliance with FinCEN regulation.

FSOs are pressured daily to comply with FinCEN’s CDD Final Rule. This is due to the inflexibilities of their legacy systems and the time-consuming part of going back and forth with their vendor to make any changes. With changing government regulations, new FinCEN guidance, updated internal audit findings and emerging bank product risks, changes that occur in the AML application need to be flexible and fast.

Built from the ground up, Xceed AML Evidence Lake™ Customer Due Diligence is designed to solve this limitation for FSOs.

Xceed AML Evidence Lake™ CDD Features

- Customize and configure your own KYC forms to accelerate KYC form entry.

- Reduce customer onboarding time with real-time onboarding monitoring.

- Safely manage high-risk customers with real-time ongoing monitoring.

- Test and validate customizable risk factors at any given time.

Xceed AML Evidence Lake™ CDD Benefits

- Easy to Use, Customizable KYC: Our KYC form is fully customizable, dynamic, and intuitive to reduce form entry time. The KYC form is stored in the Evidence Lake KYC repository which ensures the KYC information is retained for as long as requested.

- Real-time Customer Risk Onboarding Monitoring: All prospects being onboarded will automatically be risk rated in real-time as part of the customer onboarding monitoring process. A real-time alert is generated if the risk is deemed high allowing for same-day customer onboarding and better customer satisfaction.

- Configurable Risk Factors and Validation: All risk factors are fully configurable in a quick two-step process, allowing for quick threshold adjustments to satisfy regulatory or audit findings. All changes can be validated in a before-after report, showing how many more high-risk alerts would be generated, to give you a peace of mind on the business impact of the change.

- Relationship Investigation with Multi-channel Link Analysis: With one click, identify all beneficial owners, ultimate beneficial owners (“UBO”), controlling parties, and ownership percentages related to your subject. In addition, the Multi-channel Link Analysis also reveals signers, transactions and other metadata related to each person/entity in the graph.