Finding UBO Without Beneficial Ownership Registries: data driven solutions to the challenges of beneficial ownership compliance

September 16th, 2020

One of the most pressing challenges to beneficial ownership compliance is lack of available beneficial ownership information. How can financial institutions comply with stringent laws and regulations, when most governments have not produced the long-promised public beneficial ownership registries?

There is actually a tremendous amount of publicly available data that can help us address these challenges, if we can capture it and unlock its value with the right technologies.

Inconsistent access to beneficial ownership registries

Financial institutions need access to detailed beneficial ownership data to meet compliance requirements. However, there is significant variability in how countries have (or have not) implemented beneficial ownership laws and regulations.

The European Business Registry Association (EBRA) conducts a global survey across corporate registries every year. 93 registers responded to their latest survey in March 2020. Of those 93, 55 collect any ownership information, and only 29 collect and maintain beneficial ownership information.

This pattern holds true even in the European Union (EU), where the recent 5th AML Directive (5AMLD) tried to mandate a consistent and transparent implementation of beneficial ownership guidance and data availability. This March, Global Witness found that only about 18 percent of EU member states were compliant with 5AMLD.

The problem is even more acute when we consider the availability of beneficial ownership data: assuming the data exists, can you access it as a non-government entity? Per the same EBRA survey, only nine of the 29 registries that collect beneficial ownership data make it available outside of government.

This suggests that only a fraction of countries (allowing for an imperfect survey response rate) have a clear requirement for companies to disclose their true beneficiaries—and a mechanism for them to do so publicly. But the need to comply remains. Even if this number were double or triple, it would still present an obvious problem for financial institutions.

We can always hope for greater transparency: Bermuda, for example, has just said it would open its beneficial ownership register to the public in 2022, which would set a great precedent for other offshores. But, based on these numbers, we need to put aside the idea that governments are going to swoop in with new official beneficial ownership registries and solve this problem for us, at least in the near future.

What can we do in the meantime?

Leverage other public data sources

Our access to beneficial ownership registries across the world is limited. However, there is a tremendous amount of other publicly available data that contains beneficial ownership information, hiding in plain sight.

This data is not easy to find, of course. It is held in disparate databases across the world. Company ownership data may not be held in a company register; it might be held by a tax authority, as in Norway, or by procurement authorities, as in Venezuela.

And once you find this data, it’s not easy to use. It may not be structured or searchable in its native form. Companies can be owned from anywhere in the world, through complex nested structures, so you have to be able to resolve across datasets and languages.

Yes, there are challenges—but what matters is that the data exists publicly.

If you can collect this disparate data and apply graph database technology to help connect the dots, you can address many of the key challenges involved in beneficial ownership compliance without relying on official registries.

Building a beneficial ownership solution

There are three core components of publicly available data that we need to build a beneficial ownership solution: attributes, relationships, and references.

- Attributes

First, we need rich identifying information to enable connectivity. If an entity appears in one data source, we need to resolve that entity with appearances in other data sources from across the world. This matching and resolution requires attributes—ideally unique identifiers, but also other identifying information such as dates of incorporation or birth, addresses, or citizenship.

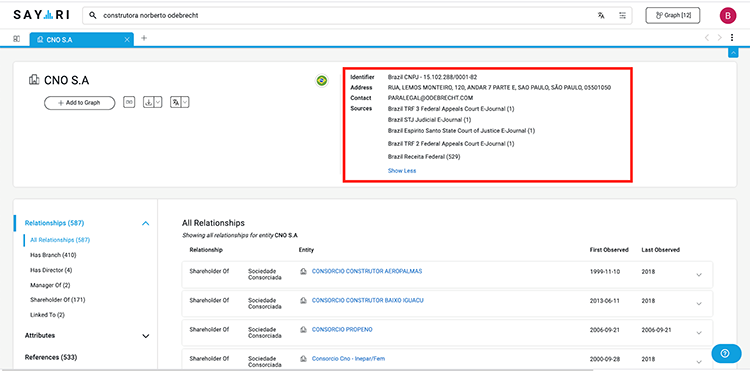

Fig. 1: Snapshot of profile for Construtora Norberto Odebrecht, S.A., a Brazilian construction company that has been at the center of one of the biggest corruption scandals in Latin American history. Attributes gathered from multiple public records sources are highlighted.

- Relationships

If attributes are the first step in creating connectivity, relationships are the second. For understanding beneficial ownership, we need to focus on ownership and control relationships, including details like share percentage.

Extracting these relationships correctly is critical; ultimately, they will link together to map comprehensive beneficial ownership. For example, armed with detailed Chinese corporate records, we can use graph database technology to automatically identify a company’s beneficial owner through multiple nested layers.

- References

References are the final component. Where did we get the data? Can we verify it? We need to maintain precise and accurate provenance back to the original source, particularly when we have utilized non-obvious sources or linked multiple sources together to identify a single beneficial owner.

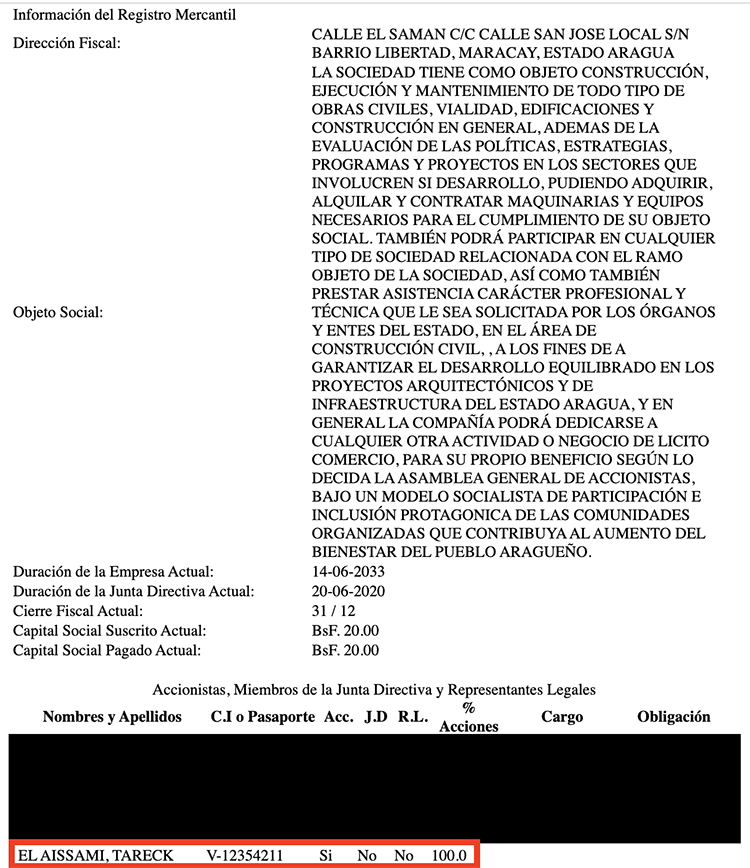

For example, Tareck El Aissami is the former Vice President of Venezuela and current Minister of Petroleum. He is wanted by multiple law enforcement agencies and has been sanctioned by the U.S. Department of the Treasury for his alleged involvement in drug trafficking. We can use open source data and graph analytics to run a beneficial ownership query in reverse—in other words, to identify all the companies that Aissami owns, like Construcciones Aragua, S.A.

Fig. 1: Snapshot of part of the corporate filing for Construcciones Aragua S.A. from the Venezuela Contractors Registry, showing the company’s address and business purpose, along with Tareck El Aissami’s Venezuela cedula number and percentage of shares.

All this rich information on company shareholding and control structures comes from an official government registry in Venezuela. But this is not a traditional corporate registry. This data actually comes from their government procurement system. Non-obvious or “proxy” sources like this are a valuable resource, particularly in opaque jurisdictions. In the British Virgin Islands, for example, you often will find more valuable beneficial ownership information in the court records of Russian oligarchs suing each other than you will in the official corporate registry.

Moving Forward

In conclusion, there are very real challenges to beneficial ownership compliance, many of which remain unresolved. But we can begin to address these challenges by applying the right data and the right technology to unlock its value.

For more information on how to incorporate public data into your beneficial ownership solutions, please contact David Lynch (dlynch@sayari.com).

Additional information:

Watch the on-demand webinar with Sayari here.

See Sayari in the X-Sight Marketplace here.