Are We Already in a Cashless Society? Three Part Blog Series

February 1st, 2018

Introduction to the Series

Think about the last time you walked into a bank branch, or wrote an actual physical check. What about how often you use cash, compared to a few years ago. I think you could agree that most people living in large Western economies are doing all of those activities less than ever before. The data from various surveys supports this; for instance, roughly 40 percent of UK residents across various demographics believe that cash will be gone in 25 years. Despite this, the number of actual bills and coins in circulation is growing in the U.S.!

Here in the U.S., the changes in all of those areas are dramatic and show little sign of slowing down. Like the transformation we’ve witnessed in other domains (transportation such as Uber and Lyft, telecommunications with Skype, FaceTime or WhatsApp, or the hotel industry with AirBnB and HomeAway), the payments industry is likewise undergoing a seismic – albeit slightly slower – transformation. In this three-part series, we’ll break down the use of cash in the United States. First, we will look at the benefits of a society that is increasingly cashless. In part two, we’ll talk about some of the disadvantages of a cashless society, and in part three, we’ll discuss some of the implications to financial crime and security as it relates to cashless societies. While the nuances among countries can be significant, this series will focus solely on the U.S. market.

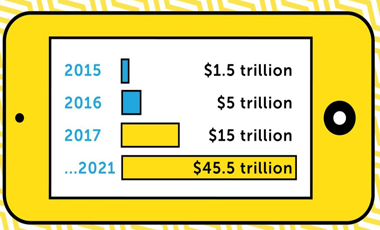

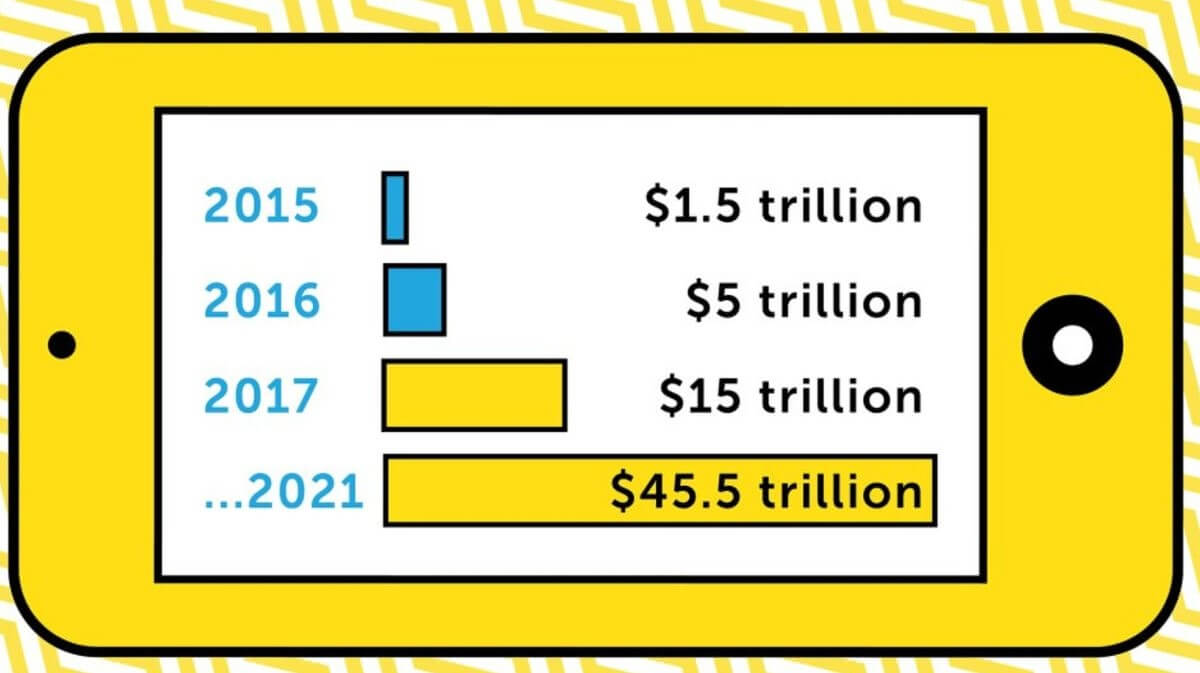

Image 1: Cashless transactions in China, via @bill_gross

Part 1: The Benefits of Going Cashless

The positive side of going cashless has been well-documented in various reports and articles. If you take stock of this information, a few key areas that touch on both consumer behavior and issues of national interest become clear. In no particular order, here’s how I think it makes sense to consider these potential benefits:

-

Easier to Regulate: Let’s start with the elephant in the room (despite some obvious political differences readers may have). Regulation is simply made easier through increased use of digital and card payments. The data, frequency, type and other metadata around such payment information is much easier to collect on a large scale and therefore easier for a particular governing body to regulate, should it wish to do so. This is not an endorsement of regulation but rather simply a statement of the ease with which a cashless society can more easily be a regulated society. Such regulations could have to do with illicit transactions, with alimony and child care, with taxation, and a slew of other sub-topics. Moreover, the country in which a cashless society exists will also see patterns and trends if they are given access to the data types, locations, amounts and more.

-

Reduction in “Black Market” Activities: Study what

India is experimenting with in the past 18 months and you will quickly understand much of what is driving Prime Minister Modi’s fierce and highly unusual campaign against cash. Whatever your view of India and its politics, and the Prime Minister specifically, there’s no getting around the fact that what he is trying to do is virtually unprecedented, especially on the scale that he is dealing with (a population of over

1.3 billion people). Specifically, Modi has been advancing his case against cash by verbally linking his campaign to corruption and black money: “In the past decades, the specter of corruption and black money has grown. For years, this country has felt that corruption, black money and terrorism are festering sores, holding us back in the

race towards development.” While India is only one country, it is representative of a major shift in what is possible, even in large economies.

-

Better Identification of Customer Needs Through Advanced Analytics: From a financial services organization’s point of view, the move to a cashless way of transacting provides numerous opportunities for better and more accurate identification of customer behavior. By looking at more transactions over longer periods of time, financial services organizations and customer experience experts can more predictably target client niches, offer new products and services, and anticipate seasonal spikes and other currently hard-to-anticipate behavioral changes. As fintech companies come after traditional banks, we cannot underestimate the importance of this visibility.

-

Reduction in the Under-Banker and Unbanked: By moving to a cashless society or cashless economy, this alleviates some of the ubiquitous issues inherent in underbanked communities. For instance, the problems associated with physical location of bank branches are significantly reduced, neighborhoods that struggle to receive adequate banking services are less likely to suffer such problems, and employees are less likely to lose large percentages of their paycheck to check-cashing services that sometimes charge exorbitant rates.

-

More Automation: We’re witnessing a massive shift to

the use of software robots and process automation across the financial services industry. This technology spike will not go away anytime soon. Cashless societies that experience larger amounts of transactional activity across new types of transaction types within highly responsive underlying systems will benefit from having a partially automated approach to analyzing these patterns, identifying risk and quickly mitigating problems.

- Merchant Handling of Cash: Many merchants talk about the challenges of handling cash and there are often discussions of the relative merits of cash vs. no cash options. Handling cash can be problematic in crime-prone areas, with employees who cannot be trusted, and with the costs incurred from storing, securing, processing and ultimately moving cash. While it’s not a black-and-white situation, it does demonstrate that merchants can easily understand the advantages of going cashless.

Now we have a handle on why going cashless is potentially good for consumers, governments and merchants alike. While it’s not a “no-brainer,” it is relatively easy to see the merits of this point of view. In the next part of our series, I will turn to the disadvantages of going cashless and explain some of the risks inherent in that approach.

Image sources:

1. Harris, J. (2018, January 23). Cashless Transactions [Twitter Image]. Retrieved January 26, 2018, from

https://twitter.com/Bill_Gross/status/955709373258649600