Check Fraud-Orchestrated Attacks and the Rise of Mule Accounts in Community Banks and Credit Unions

September 27th, 2024

Recent news has highlighted a concerning trend in the world of financial fraud: so-called “glitches”, the recent viral trend on social media that encouraged people to deposit fake checks for large sums of money, exploiting a financial institution’s (FI) fund availability glitch, and they cash out the funds immediately before those checks bounced. These aren’t free or infinite money glitches. There isn’t a cheat code for free money like there was in your favorite video game—it’s modern-day check fraud. And the sense of gamification is purposeful. Bad actors use the feeling of gamification to diminish the perceived seriousness of what people are engaging in. These memes and other social media tactics that go viral amplify their message to create chaos and flash fraud. It is my opinion that organized fraud rings are targeting FIs to exploit and perpetrate widespread check fraud, amplify via social to create chaos, and use this chaos to hide amongst those who piled on. While these high-profile incidents have predominantly targeted larger FIs, community banks, credit unions, and regional banks are not immune. In fact, the nature of these orchestrated attacks means that smaller FIs are equally susceptible.

Glitches and the Meme-ification of Fraud

Just as the meme stock phenomenon drove a wave of speculative trading because of social media, the “meme-ification of fraud” is fueling similar energy—but this time, it’s leading individuals into illegal activities. Social media platforms like TikTok, YouTube Shorts and X (formerly Twitter) have amplified these fraudulent schemes, turning them into viral trends. Once a glitch is discovered, it quickly spreads online, attracting participants looking for quick, easy money. This phenomenon can create flash fraud and put FIs at risk. But it also directs significant attention toward smaller FIs, where defenses for both account opening and check fraud may be perceived as easier to bypass. Keep in mind that organized fraud rings require sophisticated mule rings to cash out effectively; usually with accounts spread across multiple FIs.

Glitches as a Front for Organized Fraud

The effectiveness of exploiting such glitches involves four distinct phases:

- Mule Ready: Fraudsters use synthetic identities and stolen information to open new accounts, establishing an extensive network of mule and drop accounts to facilitate the rapid movement of funds

- Testing: Where bad actors systematically probing banking systems for weaknesses to exploit

- Action: Fraudsters than exploit FI defenses by depositing fake checks through channels such as ATMs and mobile apps, then withdraw or transfer the funds before the fraudulent checks can be detected

- Crimefluencing: Amplification of the FIs fraud defense through social media to generate flash fraud creating chaos to enable them to both; maximize their theft, and obscure their actions due to the overwhelming volume of investigations, SARs and referrals to law enforcement

The Rising Threat to Community Banks and Credit Unions

While large institutions have made headlines, community banks, credit unions, and regional banks are just as vulnerable. In many ways, smaller institutions represent prime targets for fraudsters due to several factors:

- Perceived Weaker Defenses: Smaller institutions may not have the same level of resources to dedicate to advanced fraud detection systems, making them attractive targets for fraudsters

- Customer Trust and Community Ties: Community banks and credit unions often have strong relationships with their members, sometimes leading to more lenient account opening procedures that fraudsters can exploit

- Limited Use of AI in Fraud Detection: Due to budget constraints, smaller FIs might lack the sophisticated, multi-layered fraud detection systems necessary to combat these highly organized attacks effectively

The Escalating Risk: Check Fraud and New Account Fraud Stats

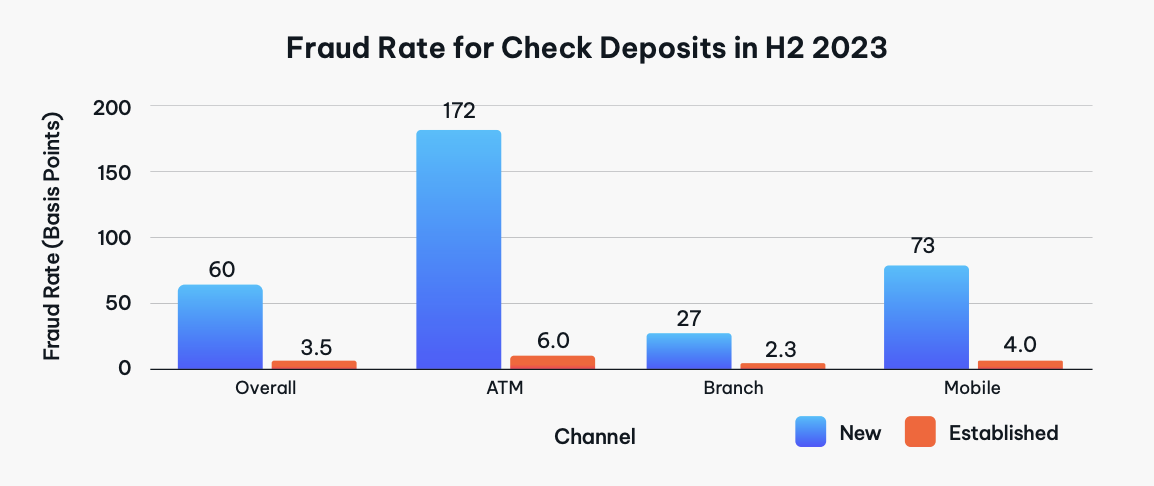

According to the 2024 NICE Actimize Fraud Insights Report, check deposit fraud has seen a 31% increase in value and a 4% increase in volume over the past year. New accounts pose a particularly high risk, with fraud rates for new account deposits being 17 times higher than those for established accounts. For smaller institutions, this presents a significant challenge:

- ATM Deposits: The average fraud cost per check deposit increased by 16%

Mobile Deposits: Experienced a 21% increase in average losses

These statistics underscore a harsh reality: community banks and credit unions face a growing risk of check fraud, particularly through new accounts opened via remote channels. Fraudsters are exploiting the same vulnerabilities in smaller institutions that they target in larger ones.

Organized Attacks with Mule and Drop Accounts

Fraudsters are not acting in isolation. They are building a vast infrastructure of mule and drop accounts, which are used to facilitate these fraud schemes. This network includes accounts opened using synthetic identities or recruited individuals, designed to move funds rapidly before detection. Smaller financial institutions, which may have fewer resources to identify and stop this network, become ideal targets for these organized schemes.

The Meme-ification of Fraud and Its Impact on Smaller Institutions

The meme-ification of fraud turns these criminal activities into viral trends. As methods are shared across social media, the reach of these schemes extends well beyond large banks. Community banks and credit unions, often regarded as safer and more customer-friendly, are now at risk of being overwhelmed by a sudden influx of fraudulent activity. Ordinary individuals, including existing customers, may be drawn into these schemes, thinking of them as harmless ways to make money quickly without realizing the serious legal implications.

Why Community Banks and Credit Unions Must Act Now

While recent incidents have primarily involved larger institutions, the reality is that smaller FIs are equally at risk. Fraudsters do not discriminate based on the size of the institution; they seek out vulnerabilities wherever they exist. For community banks and credit unions, the implications are significant:

- Financial Losses: Smaller institutions may not have the financial buffer to absorb significant losses from a major fraud event

- Reputation Damage: These institutions often rely heavily on trust and community reputation. Being associated with a large-scale fraud incident can have long-lasting impacts on customer confidence

- Regulatory Pressure: Even smaller institutions are under increasing regulatory scrutiny to implement adequate fraud prevention measures

What Smaller Financial Institutions Can Do

Community banks, credit unions, and regional banks must take proactive steps to protect themselves from these evolving threats and seek a partner like NICE Actimize that provides comprehensive Fraud and AML solutions to FIs; from the largest banks in the world to the small and midsized community banks and credit unions.

For Small- Midsized Finacial Institutions, NICE Actimize’s Xceed FRAML Solution is Purpose Built for Your Unique Needs and Complex Challenges:

- Strengthen New Account Monitoring: Enhance new account opening procedures with advanced identity verification and early account monitoring to identify synthetic identities and prevent the establishment of mule accounts

- AI Powered Fraud Detection: Use behavioral analytics to monitor transaction patterns and detect suspicious activities indicative of mule operations. Real-time fraud detection can help smaller institutions quickly identify and respond to fraudulent activities

- Implement Advanced Check Fraud Detection: Check image analytics and verification to enrich behavioral analytics. These tools can help detect anomalies and prevent fraudulent checks from being processed

- Customer Education: Educate members about the risks of engaging in money glitches and other viral fraud schemes, emphasizing the legal consequences and the impact on the institution

The Path Forward for Smaller Institutions

The rise of check fraud and new account fraud is not confined to large banks; it is a growing threat to community banks, credit unions, and smaller financial institutions. The recent focus on glitches highlights how quickly fraud trends can evolve and how easily they can be amplified through social media. For smaller institutions, the message is clear: Proactive protection is essential. By adopting fraud detection technologies with AI and advanced analytics, strengthening account monitoring, and educating customers; smaller FIs can be prepared to fight against these organized and evolving threats.

Fraudsters are not slowing down, and the meme-ification of fraud every institution, regardless of size, must be vigilant and proactive in their approach to fraud prevention to protect their customers and maintain trust.

For more information on NICE Actimize fraud solutions built for community banks, credit unions, and smaller financial institutions, click here.