Check Imaging Systems – Data Improvements Needed to Fight Fraud

November 19th, 2014

Join subject matter expert Wesley Wilhelm for a December 11 Webinar, “Mobile Check Deposit & Real-Time Decisions.” Register here for the event.

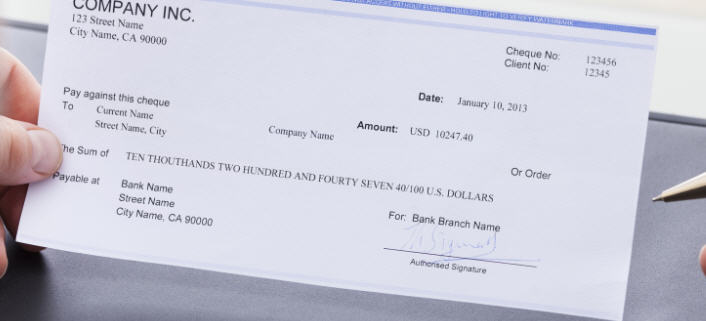

Fighting mobile check deposit fraud will require more data than most banks and vendors are typically collecting.

With the highly successful, near comprehensive roll-out of check imaging systems at branches, ATMs, in-clearing channels, and the exponential growth in Mobile Remote Deposit Capture (MRDC), one could assume that imaging systems are now mature and that they provide all the data necessary for fraud management. Unfortunately, that often isn’t the case. According to Celent, adoption in this area has been fast: Through 2013, 90% of US financial institutions have installed branch capture. More than 60% have offered merchant capture, and more than 50% of deposit-taking ATMs were image-enabled. Read the rest of Wes’ blog post on Bank Systems & Technology.