Harnessing the Power of NICE Actimize’s ActOne10: Empowering the Battle Against Evolving Fraud

August 18th, 2023

Case management in fraud prevention is the overall process in managing and handling individual fraud cases that are detected or flagged by a detection system. While fraud must be detected and interdicted in real-time, post-alert triage and claims management is essential to uncovering additional fraud risk within your institution and effectively managing the claims. The majority of fraud detection solutions come with their own case manager; however, it is in this fragmentation or proliferation of point solutions that FIs lose the ability to effectively manage the entire lifecycle of an alert or see the entire risk of the customer.

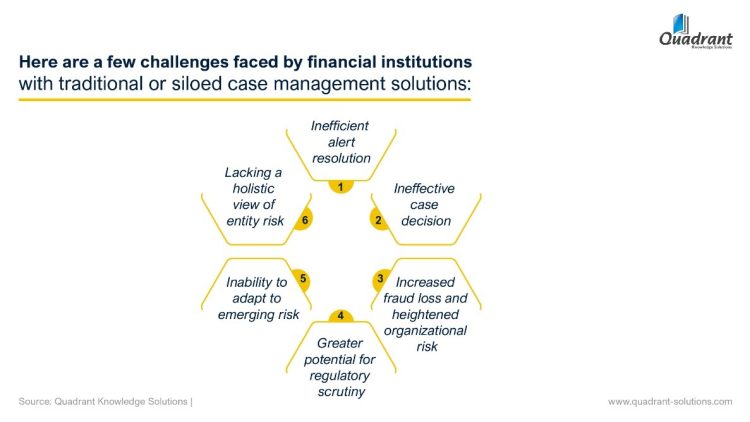

In today’s ever-changing landscape, fraudsters are continually raising the bar with their sophisticated tactics, which leaves fraud detection teams struggling to keep up with the complexity of fraudulent activities. As a result, fraud detection teams find themselves struggling to match the complexity of these fraudulent activities with their existing fraud detection and case management tools. Gathering crucial information for each case becomes a cumbersome task, leading to delays and a lack of collaboration amongst teams. Financial institutions that use traditional or siloed case management solutions face will face great fraud loss, poor customer experiences and expose themselves to heightened regulatory risk.

End-to-end enterprise fraud management solution with a fully integrated case manager that can unify both risk signals and alerts is the cornerstone of the modern fraud operations team. NICE Actimize offers a resilient case management solution, ActOne, which forms the very foundation of its industry-leading financial crime and compliance solution portfolio. NICE Actimize’s ActOne is a purpose-built case management solution meticulously designed and fully extensible to address the complex and specialized need of financial institutions. Recently, NICE Actimize launched their next-generation case manager ActOne10. With ActOne10, NICE Actimize has further enhanced its case manager to empower financial institutions with speed, agility, and intelligence for swifter, smarter investigation to combat financial crime and address regulatory risk. The new AI-powered ActOne10 offers dynamic workflows, risk insights, and network analytics in one unified platform, automating repetitive tasks, providing deeper insights, and streamlining workflows for effectively solving complex cases.

Here are the new features of NICE Actimize ActOne10

Unlocking the Power of Dynamic Risk Calibrated Workflow:

Flexibility and adaptability play a crucial role in efficient case management. NICE Actimize ActOne’s dynamic workflows streamline case management processes. Unlike static workflows that lack flexibility, ActOne’s dynamic workflows utilize real-time data and intelligence, creating a seamless and adaptive case management process. Intelligent automation promptly escalates high-severity alerts for special handling while hibernating low-risk alerts until they recur, empowering case managers to focus on critical tasks. The icing on the cake? The no-code configuration feature enables fast and compliant customization without cumbersome coding, reducing manual efforts and speeding up case resolution.

Unleashing the Power of Analytics and Decisioning:

NICE Actimize ActOne’s policy manager allows users to create rules using an intuitive user interface. The platform’s advanced analytics identifies hidden relationships and explore networks to identify risks, ensuring a comprehensive understanding of fraud patterns. Identity resolution identifies the connections between customers, empowering better investigations by gaining a comprehensive view of each entity. On the other hand, network analytics delve into interconnected relationships, offering pattern recognition, anomaly detection, and visualization for a more profound analysis of complex cases. The seamless synergy between identity resolution and network analytics equips investigators with data-driven insights, enabling them to confidently tackle cases.

Unravelling the Visualization Powerhouse:

NICE Actimize’s ActOne10 introduces a visualization entity graph, revolutionizing the investigation processes. Through a combination of the visual workbench, enhanced personalization, and network exploration, investigators can now enjoy a smarter and faster workflow. The Visual Workbench prioritizes high-priority items, improving user performance and response time. It also offers enhanced personalization options, allowing users to set activity preferences based on personalized views. The Network Exploration feature provides users with a unique perspective as it visualizes both familiar and direct relationships, while also expanding investigative discovery to uncover indirect risky relationships. ActOne’s flexibility in displaying multiple pop-ups in a single view further enhances investigative capabilities, making it a powerful visualization tool.

A Strong Ecosystem – Enhancing Fraud Detection:

NICE Actimize’s strength lies in its robust ecosystem, which leverages X-Sight DataIQ and X-Sight Marketplace to deliver enriched data. These AI-enabled technologies gather information from diverse global data sources, enhancing customer profiles and providing essential intelligence to combat fraud. Through correlation and matching of third-party data sources, duplications are avoided, and machine learning technology streamlines the process of accurately identifying customers. As a result, the data for customer profiling becomes enriched and more valuable.

Let’s delve into the challenges faced by customers and how NICE Actimize’s ActOne10 helps to solve those challenges-

- Delayed Responses: In the fast-paced world of fraud, swift action is paramount. Delays in responding to potential threats can spell disaster, so NICE Actimize’s ActOne10 prioritizes agility in its workflows to accelerate investigations and reduce time spent on non-analytical, mundane time-consuming tasks in a manner that is fully transparent, auditable and compliant.

- Lack of Data: Siloed and fragmented data is a significant roadblock in combating fraud effectively and impeding the speed of investigations. NICE Actimize’s ActOne10 offers seamless access to data that is delivered directly into the investigation where it’s needed and when for intelligent risk insights for better outcomes.

- Limited Insights for Improvement: Traditional approaches may offer only a shallow view of fraud patterns. NICE Actimize’s ActOne10 continuous feedback loops into Actimize detection solutions breaks barriers and further supports their advanced analytics, empowering organizations to dive deep and continuously enhance their fraud prevention efforts.

- Scattered Information: The investigation process is affected by a fragmented view of the customer which can slow down investigation into complex and connected financial crime. However, NICE ActOne’s Network Risk continually resolves the customers identity and to ensure a singular view of customer risk and then extends the search for risk to associated risk to uncover those high-risk indirect relationships. with powerful network analytics.

- Inefficient Resource Utilization: Manual efforts can be time-consuming and resource intensive. NICE Actimize ActOne10 optimizes resource utilization through intelligent automation, alert assignment and streamlining case management workflows.

NICE Actimize ActOne10 emerges as Industry-leading case management solution in the fight against evolving fraud and financial crime. Its innovative features, including dynamic risk-calibrated workflows, advanced analytics, and a visualization powerhouse, empower organizations to stay ahead of fraudulent activities. By addressing customer pain points and enhancing fraud operations capabilities, NICE Actimize ActOne10 solution helps to fight the battle against bad actors ensuring safer and more secure transactions for businesses and customers alike.”