Network Analytics in Financial Crime and Compliance

March 5th, 2024

The Revolutionary Impact of Network Analytics in Financial Crime and Compliance

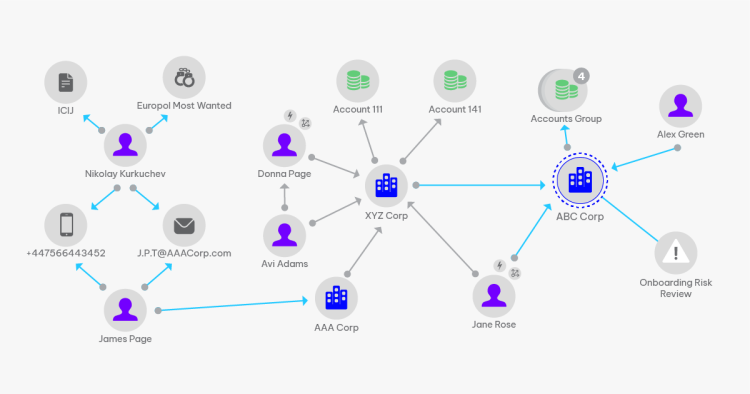

Network analytics is a crucial tool when it comes to combating fast-evolving financial crimes. It reveals connections to suspicious activities, significantly improving investigations. Traditionally, network analytics in financial institutions (FIs) were siloed from main investigation platforms, requiring manual efforts from investigators. However, advancements in AI, analytics, and graph database technology have transformed its role, allowing for automated analysis and more effective risk uncovering.

Silos Cause Bottlenecks

FIs face issues like high false positive rates and investigation fatigue due to using multiple systems. However, network analytics can augment alerts with additional context, providing a more comprehensive view of customer activity. This technology is essential in today’s complex financial crime landscape, where criminals often operate across multiple jurisdictions, making it challenging to track their activities. Graph databases, optimized for examining structures and relationships, are particularly effective in unraveling intricate connections that traditional databases struggle to identify.

Network analytics is now pivotal in both detection and investigation, identifying unusual patterns and expediting decision-making. It helps in understanding the relationships between entities and the nature of these connections, essential components in fighting money laundering and fraud.

Its application in financial crime and compliance operations is vast, from uncovering risks in correspondent banking to detecting network burst activity in corporate banking and identifying money mule activity in retail banking.

Integrating Network Analytics Tools

For effective use, FIs need to ensure the network analytics tools they choose minimize the need for excessive manual operations and focus on highlighting crucial entities. Data cleaning and validation are also essential in mitigating potential setbacks. The strategic integration of network analytics requires consideration of specific risks, capability focus, and case management integration. A cultural shift is also necessary, with emphasis on training and adjusting investigation processes.

The future of network analytics in financial crime and compliance is promising, especially with increased cloud adoption and the intersection with generative AI. This powerful combination can lead to more accurate models and reduce false positives, enhancing risk detection without increasing alert volume. Network analytics is an indispensable tool in the arsenal of FIs, enabling them to navigate the complex landscape of financial crime and compliance with agility and adaptability.

NICE Actimize Network Analytics

Traditional tools and techniques are unable to address the challenges posed by connected financial crime—that takes sophisticated network analytics and exploration. With ActOne Network Analytics, FIs have a powerful investigative tool that visualizes connections, providing investigators with greater insight into an entity. NICE Actimize stands as a key partner in an FI’s journey, helping them achieve a more effective financial crime program using innovative tech that mitigates risk.

For more information on using network analytics to uncover hidden risk, read the insights article.