March Madness 2026: Why the End of Federal Paper Checks Will Pressure Banks — and Expose New Risks

June 23rd, 2025

A quiet but profound shift is underway in the U.S. payments system. In March 2025, the White House issued a mandate: by the end of FY2025, virtually all federal government payments — including tax refunds — must move off paper checks and onto electronic channels, primarily ACH.

While this is a victory for efficiency, it will drive sudden, uneven increases in ACH volume — and with it, operational, fraud and compliance challenges that many financial institutions (FIs) are underprepared to manage.

Coupled with NACHA’s new ACH Rules, which change liability for refunding payments made under false pretenses or unauthorized ACH credits, this shift will reshape how banks handle a seasonal surge of payments that is ripe for abuse.

Banks and credit unions need to be ready.

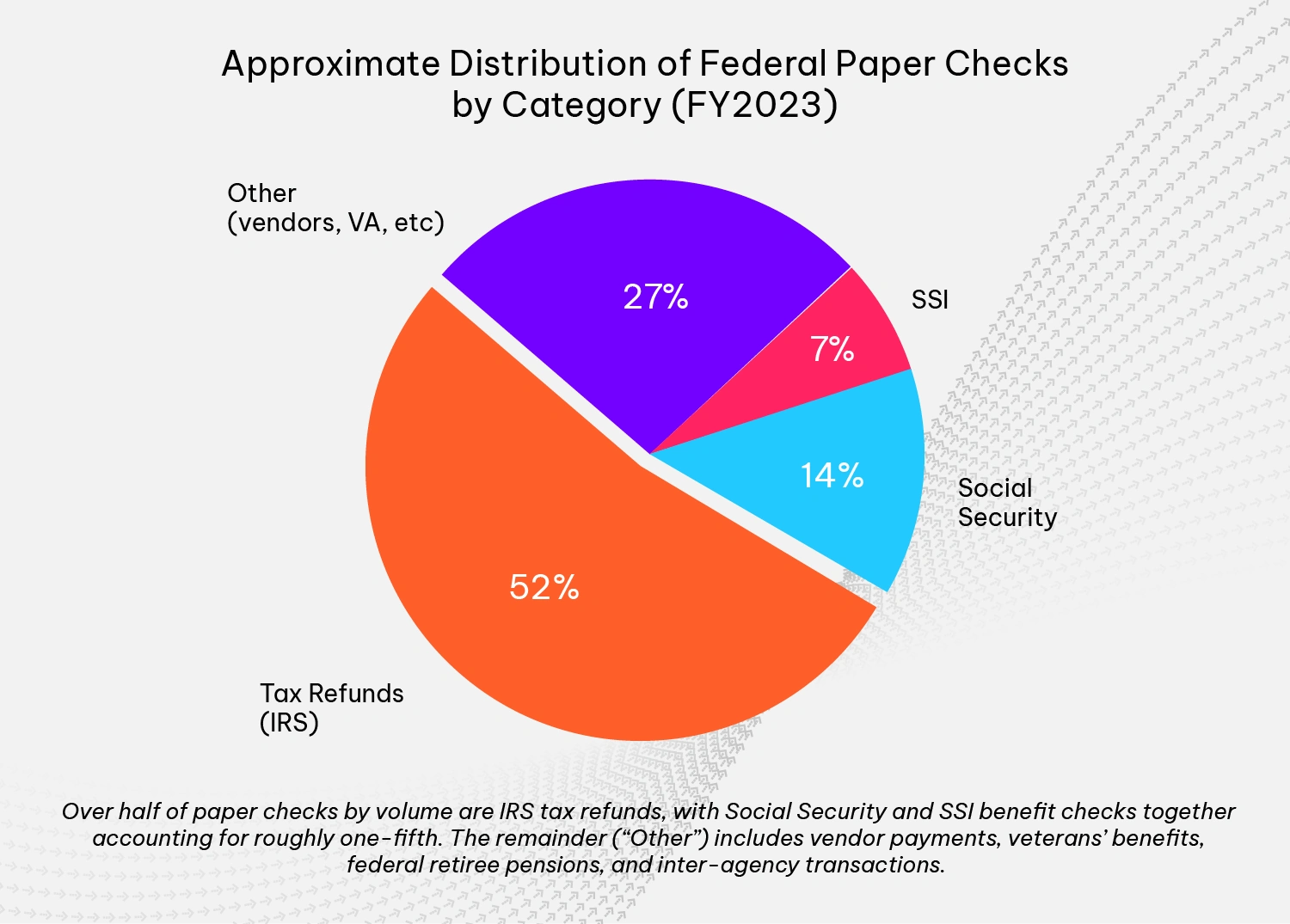

Breakdown by Payment Category

As shown above, federal paper check usage is concentrated in a few key payment categories. The largest share of paper checks is for IRS tax refunds, which constitute roughly half of all federal checks by volume. Most of the remaining checks come from federal benefit payments — primarily Social Security and income-support programs — along with a small fraction from vendor/contractor payments and other miscellaneous disbursements.Paper vs. Electronic: Overall Proportions

Thanks to decades of effort, the federal government’s payments have become overwhelmingly electronic. In FY2023, about 96.45% of all Treasury-disbursed payments were made by electronic funds transfer (EFT), with only 3.55% paid via paper check. This is a dramatic change from prior generations. The shift to 96–99% electronic payment has yielded both cost savings and a reduction in fraud: paper checks are 4 times more expensive per payment and 16 times more likely to encounter problems compared to EFT. The median paper check issued by Treasury is also relatively high-value (around $4,861 on average), meaning that even the small percentage of checks account for significant dollar amounts. A White House directive (March 2025) instructs that effective September 30, 2025, the federal government will cease issuing paper checks for any payments — including tax refunds, vendor payments, benefits and even agency-to-agency transfers — except in rare emergency or hardship cases.ACH Volume: The Coming Surge

About 20% of federal tax refunds and over 50% of all federal checks are still issued by paper check — equating to roughly 20–25 million checks per year. With the new mandate, nearly all remaining check-based refunds will be pushed to ACH. The result will be an ACH volume increase of at least 20–25 million additional high-dollar refund credits, compressed into a short seasonal window (January–May). For mid-size and smaller banks, this creates risks:- Time-based volume concentration: Tax refund ACH volume will spike in just a few weeks, stressing ops teams and core systems.

- Rising exposure to refund fraud: Bad actors exploit ACH refunds to perpetrate synthetic identity fraud, mule activity and account takeovers.

- Customer experience risks: Unexpected holds, delays or reversals will lead to dissatisfaction and social media fallout.

The ACH Rule Change: A Game-Changer for Liability

Under NACHA’s new ACH Rule (effective March 2026), RDFIs will face expanded obligations to return certain fraudulent or unauthorized consumer ACH credits quickly — and in many cases, bear liability for refunds to ODFIs. This means:- Record volumes of first-time ACH tax refunds, many going into “new” or dormant accounts.

- Rising attempts by fraudsters to exploit refund flows — especially via mules and synthetic accounts.

- Increased accountability — banks are responsible if they fail to identify and stop fraud flows in time.

How Scammers Will Pivot — and Why Banks Must Adapt

Paper checks are slow and traceable. ACH is fast and scalable — and fraud rings know this. As the remaining 20% of refund checks shift to ACH, expect:- More “pop-up” mule accounts created ahead of refund season.

- More synthetic identities used to claim fake refunds.

- More scams targeting consumers via phishing or social engineering.

Operational Strain: Beyond Just Fraud

- Exception processing: More errors, mismatches or returned ACH items.

- Funds availability policies: Pressure to release ACHs quickly despite fraud risk.

- Customer service overload: More inquiries about missing or reversed refunds.

- Core and ACH platform stress: Smaller banks may see 2–3× normal ACH inflows during peak weeks.

Call to Action for FIs

- Tune ACH fraud models for refund patterns and first-time credits.

- Strengthen onboarding controls to block mule accounts early.

- Align ops, fraud and support teams on refund handling policies.

- Test ACH capacity and readiness for seasonal peaks.

- Educate customers about refund scams.

Conclusion

The federal check phase-out is positive — but not without consequence. It will compound risks and costs in ACH operations right when REI compliance hits. The time to prepare isn’t next tax season — it’s now. ACH will be the final wave of U.S. government payment modernization — and banks that miss the warning signs will pay the price.