Exploring RPA in Financial Crime Investigations: From Hype to Reality

December 20th, 2018

Joan McGowan recently presented a webinar with NICE Actimize to APAC titled, “Exploring RPA for Financial Crime Investigation”. To listen to the playback, please click here.

I regularly write about and speak on the operational challenges of managing financial crime, and it has become blatantly obvious that we have reached an impasse. Under the status quo, operations are barely manageable, alerts volumes are out of control, investigations are becoming more complex, and the demands on analysts and compliance teams are piling up.

With this level of pressure, error rates increase and the chance of stopping a real threat decreases. The stats are alarming.

A typical bank employee makes 10 to 30 errors per 100 opportunities, and the more rote the work, the higher the error rate. Now consider a top financial institution that employs around 12,000 analysts and compliance staff. My ballpark figure is 288,000 errors.

So is AI, specifically robotic process automation (RPA), the answer? Well it can be, if done correctly. RPA is the application of software-coded scripts governed by business logic and structured inputs that can mimic routine human activities automatically, repeatedly, faster, and more accurately. Because RPA integrates well with legacy technologies and processes, implementations are quick and ROI is fast.

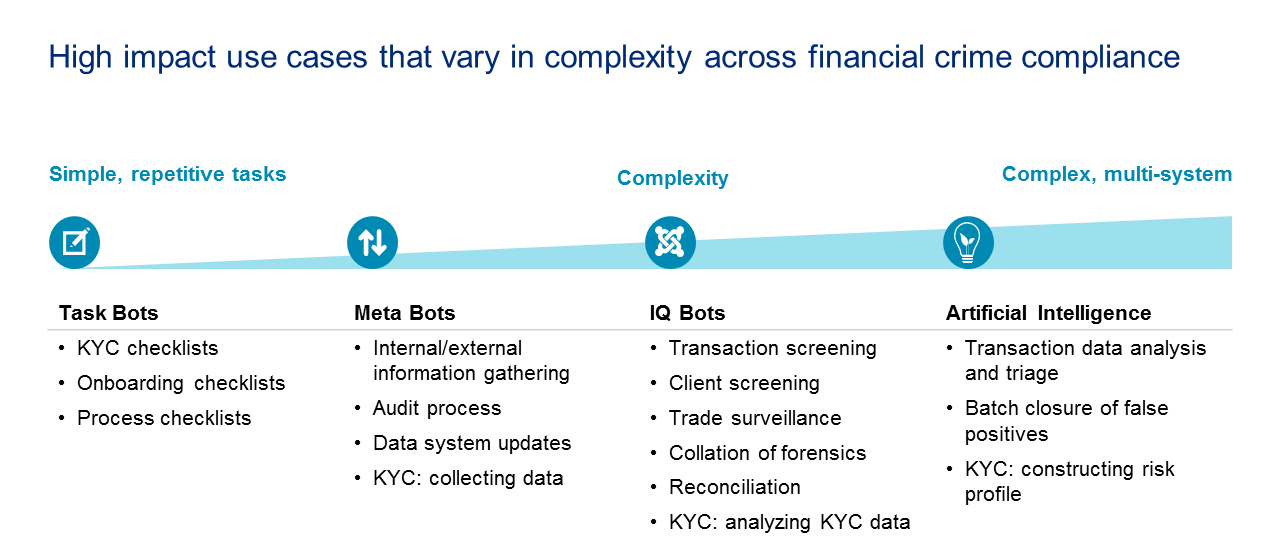

RPA is a compelling solution for the current staffing crisis. There are an abundance of activities that can be automated using robotics — from the simple task of screen scraping content to the complex automation of non-standardized and non-modular data for multiple regulatory and jurisdictional compliance requirements. Critically, automation will free up highly skilled analysts to focus on more strategic, high-value risk activities.

There are varying degrees of RPA complexity, which I will not go into in this blog — Celent analysts cover this space in great depth. In summary, RPA is ideally suited to most risk and compliance activities.

However, along with the benefits of RPA there are significant pitfalls. RPA application integration brings enhanced cyberthreats as well as inherent operational process risk failures. The promise of immediate cost reductions and process efficiencies across operations has resulted in banks being eager to deploy RPA, without fully thinking through the ramifications. Banks need to set a clear vision, governance, and performance objectives when using RPA solutions to scale up their operations.

Several recent risk and compliance implementations have not fully understood and overestimated RPA’s capabilities; as a result efficiency, savings, and productivity fell short of expectations.

RPA layers on top of systems, and if a system is changed, then the robot must be changed. If the system is broken, the robot will accelerate the problem. Banks must think of RPA as a tool in a toolbox. Alone, it will not modernize a bank’s processes.