How Does Money Laundering Work?

July 11th, 2023

The battle between money launderers and anti-money laundering (AML) teams is a multiplayer, cross-continent struggle. It requires financial institutions (FIs) to know their clients, understand their behavior, monitor for and detect patterns, and comply with internal risk management processes while adhering to compliance and regulatory requirements.

But in order to better understand the right tools and solutions to implement for AML activities, we have to right set on what money laundering actually is and how it works.

How does money laundering work

Money laundering is the process of making illegally obtained funds appear to be legitimate and is a crime in almost every country. After unlawfully earning money, criminals use a variety of methods to move their money and conceal their funds’ source, ownership, and destination. Why? Money laundering makes it easier for them to evade detection, avoid seizure of their assets, legitimize and expand their criminal enterprise, and use the proceeds for personal enjoyment or investments.

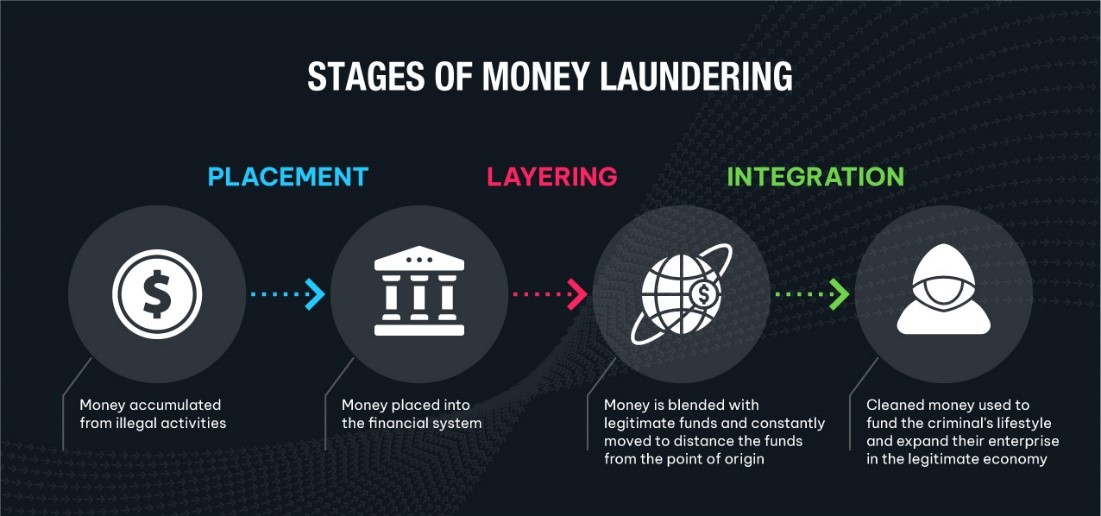

The Three Stages of Money Laundering

While criminals get more creative over time and come up with new and exciting ways to launder money, each money laundering method falls into one of three key-stage processes:

Placement

The first step in money laundering is placement, which involves introducing illegally obtained funds, sometimes referred to as “dirty money,” into the financial system. This is typically done by depositing the funds into a bank account, using the funds to purchase assets, or investing the funds in a business.

Layering

The second step in money laundering schemes is layering, which involves creating a complex web of transactions that are designed to make it difficult to trace the origin of the funds. This may involve transferring funds between multiple bank accounts, buying stocks, bonds, or insurance products, or transacting with shell companies to hide the ultimate beneficial owner (UBO).

Integration

The final step in money laundering is integration. This involves using the funds as if they are normal personal or company funds to purchase assets or complete business activities. This action makes the proceeds of crime appear legitimate, making it difficult for law enforcement officials to trace them back to their illegal origins.

How can you fight money laundering?

Fighting money laundering requires a multifaceted approach that involves cooperation and coordination among various stakeholders. FIs should not stand alone. They need to collaborate and partner with authorities and different organizations to effectively fight financial crime. Some proven ways of combating money laundering include:

Education and Awareness

Individuals can educate themselves on money laundering risks and how to identify suspicious activities. This includes being aware of common money laundering techniques and typologies and reporting any suspicious activities to the authorities.

By understanding the key steps involved in money laundering and implementing effective measures to identify it, we can help protect ourselves and our communities from organized crime, drug trafficking, human trafficking and other illegal activities.

Advocate for Anti-Money Laundering (AML) Regulations

Governments can establish anti-money laundering laws and regulations that require financial institutions and other organizations to implement measures to combat money laundering. This includes reporting suspicious transactions to the authorities and conducting due diligence on customers and transactions.

Use Innovative Technology Across Your AML Program

The use of technology, such as artificial intelligence tools and machine learning, can help enhance detection of suspicious activity that may be related to money laundering.

Strengthen Know Your Customer (KYC) Procedures

Major financial institutions and other organizations implement KYC procedures to understand their customers and screen for related risks on an ongoing basis. This helps to prevent criminals from using fake identities to open accounts and conduct financial transactions. Shifting away from periodic review towards ongoing reviews, also known as perpetual KYC (pKYC), can help organizations identify when a customer starts heading down a criminal path earlier and enable them to manage their risk more appropriately.

Screen Customers for More Than Sanctions

FIs need to go beyond sanctions screening. They can screen for Politically Exposed Persons (PEPs), including domestic, foreign, and international organization PEPs. PEPs are individuals and entities at a higher risk of money laundering and predicate crimes because of their political position, ability to influence, and their risk of being corrupted. Additionally, screening can extend to adverse media, identifying individuals and entities that have negative or damaging information published about them through open sources such as news articles, court records, regulatory filings, and social media. Screening for PEP and adverse media will effectively reduce an FI’s risk.

Enhance Suspicious Activity Monitoring with Machine Learning

Financial institutions use transaction monitoring software to pinpoint suspicious transactional activity. By incorporating machine learning into their transaction monitoring programs, FIs can minimize false positives while detecting more true suspicious activity. Machine learning can be combined with rules and other advanced technologies, like network analytics, to create multiple layers of defense for the financial institution. With these layers, FIs can ensure complete compliance while increasing system performance and refocusing resources on high-risk activities.

Increase Cooperation and Information Sharing

Law enforcement agencies and financial institutions can share money laundering intelligence through partnerships and legal means like the USA Patriot Act Section 314b, JMLIT, SAMLIT, and COSMIC. This can help identify patterns and trends in money laundering and assist in detecting, investigating, and prosecuting criminal organizations.

Prevent Money Laundering with NICE Actimize

As the fight against money laundering intensifies, it’s essential to leverage technology and advanced analytics to detect and prevent suspicious activities. NICE Actimize is a leading provider of Anti-Money Laundering (AML) software that leverages cutting-edge technology and artificial intelligence to identify potential risks and prevent further money laundering operations.

With solutions that range from customer due diligence to transaction monitoring, NICE Actimize’s AML solutions are designed to help financial institutions and other organizations comply with AML regulations and protect themselves from the risks associated with money laundering. By partnering with NICE Actimize, organizations can strengthen their anti-money laundering efforts to ensure complete compliance.