ISO 20022: Expanding Faster and Safer Payments

April 28th, 2021

According to the Chinese zodiac, 2022 will be the year of the tiger. Another auspicious occasion across the global payments industry pertains to ISO 20022, which is a global and open standardization approach for financial services, specific to electronic communication. By enabling multiple markets to communicate in a universal messaging language and model, ISO 20022 marks a significant turning point in payment digitization.

ISO 20022 is an emerging global standard for payments messaging. This standardization will provide a common language for payments data across the world, leading to higher quality data and payments. ISO 20022 was originally introduced in 2004 by the Internal Organization for Standardization to help universalize and advance real-time payment messages.

Expanded Messaging Capabilities Net Higher Benefits with ISO 20022

ISO 20022 expands the amount of data, from about 100 characters to approximately 9,000 machine-readable characters that define payment messaging to enhance both context and content readability. What additional benefits do the expanded characters provide?

- ISO 20022 users can leverage the machine-readable XML format to clarify data types and tags per message components.

- The augmented data dictionary allows messages to offer more information pertaining to business processes and activities, and payment roles.

- Cultivating a native ISO 20022 capability helps financial services organizations (FSOs) use high quality data specific to every payment and push data-first approach.

Enter Artificial Intelligence and Machine Learning

Intelligent technologies like artificial intelligence (AI) and machine learning (ML) will be critical to the realization of these benefits, which will require strategic investment and monumental change at scale. Part of the nexus of rationalizing ISO 20022 is increased automation and speed. AI and ML will be necessary for process automation that decreases friction across the payment lifecycle. The end result will be highly automated and efficient outcomes data results.

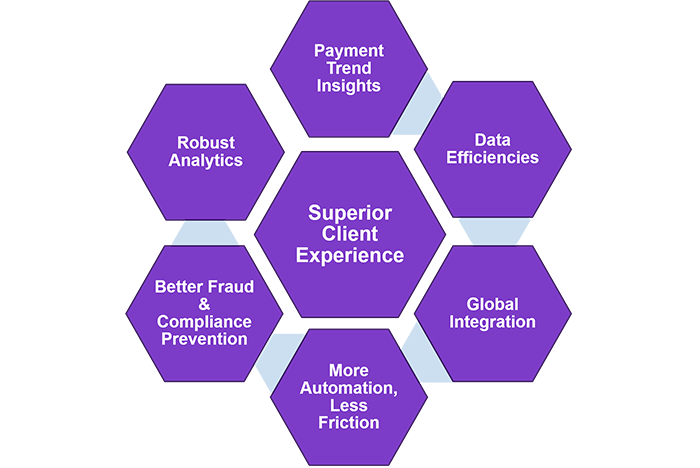

The Benefits of ISO 20022

- Superior client experience: Quality data via ISO 20022 will lead to more robust, granular data across payments messages that elevate the client payment experience.

- Data efficiencies: In certain instances, payment data and information is incomplete or fragmented, which can lead to time-consuming, expensive manual intervention and subsequent customer delays. A prevalent data dictionary and universal messaging standard enhances the level of detail surrounding payment information to minimize errors, improve information accessibility, and facilitate more efficient payment systems.

- Global integration: Financial messaging standardization addresses interoperability and integration challenges between various clearing systems within a cross-border payments landscape. ISO 20022 facilitates speed, agility, harmonization and greater interoperability within both the domestic and the international payments and currencies ecosystem.

- More automation-less friction: The application of XML syntax as a global open standard minimizes friction for automated transfers and improves straight-through processing throughout the end-to-end processing chain.

- Better fraud and compliance prevention: Granular payment data and standardized data augments information for continuously changing fraud detection and prevention models, and enables more efficient, accurate compliance reporting.

- Robust analytics: The capabilities to structure both payments messages and data components equates to faster, more relevant analytics and deeper customer payment activity insights, which can inform value-added services based on shifting customer behaviors and preferences.

- Payment trend insights: Richer customer insights helps FSOs extend more personalized, relevant and competitive services, and improved speed and efficiency of messaging leads to overall enhanced customer experiences.

Final Considerations

ISO 20022 is widely acknowledged to be highly complex and ever-changing. The process of adopting these new standards may not be easy and will consume a significant amount of time and resources to realize the final transformation. To balance the negative aspects that a project of this magnitude represents, financial services providers need to remember that regulatory pressures are rising for FSOs to introduce better safety and security measures and innovation. Furthermore, customers expect immediate, streamlined payments and greater customization and value across related services, and competitors are ramping up efforts to innovate within the international payments market.

Some additional considerations include:

- Novel methods for data collection and storage: Infrastructures need the capabilities to automate and manage data collection, storage and processing of structured, granular data.

- Legacy systems: Legacy systems generally cannot support or leverage the ISO 20022 standard, which will require FSOs to evaluate their current infrastructures to ascertain how to approach potential system, technology and tool decommissions, replacements and upgrades.

- Risk of data truncation: FSOs that approach ISO 20022 migration via application-by-application replacement or middleware solutions rather than a holistic platform approach risk potential siloed applications and data truncation.

- Lack of an implementation roadmap: Many FSOs have yet to define a finite roadmap for ISO 20022 implementation, which may strain risk management across project planning, testing, quality insurance and stakeholder involvement.

- New data schemas: New payments messaging formats will demand the development of additional data schemas to effectively add new data attributes, which typically demands support from experienced IT specialists.

- Data model optimization: Data models throughout the payment lifecycle and any payment processing systems will be impacted, such as account data, reporting, sanctions screening, and messaging, and will need to be optimized for ISO 20022.

- Fraud and AML models: Fraud and financial crime teams will need to rethink risk management approaches and solutions to account for new XML processing and data models.

ISO 20022 General Timeline

Given that every major system won’t be migrating simultaneously, global rollout is planned to occur from 2022 through 2025. However, ISO 20022 is already being utilized in more than 70 countries, and it’s approximated that the high value payment systems of all major reserve currencies will have pivoted to this standard by 2025. FSOs must start planning their migration strategies quickly in order to benefit from ISO 20022 compliance and avoid positioning their organization at a significant disadvantage, such as exclusion from international payments networks, and greater costs attributed to lower straight-through-processing rates.

FSOs who ambitiously accelerate ISO 20022 adoption are positioned to leverage greater value throughout payment chains while exploring new potential to enhance payments outcomes, compliance, and client experiences with quality data. Compatibility across technology platforms alone is worth the price of admission.

Remember – the tiger is a daring and courageous fighter symbolizing power in the face of extreme pressure. ISO 20022 adoption isn’t that dramatic or dangerous, but it does symbolize the need for everyone to see this initiative as a means of exceling in a future marketplace where only the fittest will survive in the technological jungle.

NICE Actimize’s integrated fraud management platform, IFM-X, can help with your toughest fraud challenges. Learn more here.