Thwarting Money Mules in an Instant Payments Environment

September 1st, 2023

Senior Glenda Seim looks like the quintessential cookie-baking grandmother. She’s a convicted money mule.

A money mule is someone who transfers illicit funds on behalf of someone else. Money mules can be any age, race, gender, or income level, and either witting, unwitting or complicit—but every one of them can take a different path to becoming a money mule. A witting mule might be a love-struck senior woman, like Glenda, who moves money for her “boyfriend” in another country. An unwitting mule might be a victim of identity theft who discovers his credentials were used to transfer funds in bank accounts he didn’t open—or a job seeker who gets hired for a work-from-home position that requires transferring money from a personal account to a bank account in another country. Complicit money mules know they’re involved in money laundering as part of a larger criminal scheme—they just don’t care. It’s not a stretch to say some complicit mules are entrepreneurs, too, because they might openly advertise their services, actively recruit others, or even manage a few lower-level mules in a mule ring by accepting their laundered money and directing it to funnel accounts for scammers.

Money mule operations are frequently organized in a way that insulates individual mules from higher-level criminals, helping them evade law enforcement or detection. If each mule is isolated from the larger criminal network, it’s challenging to trace activity back to the ring leaders.

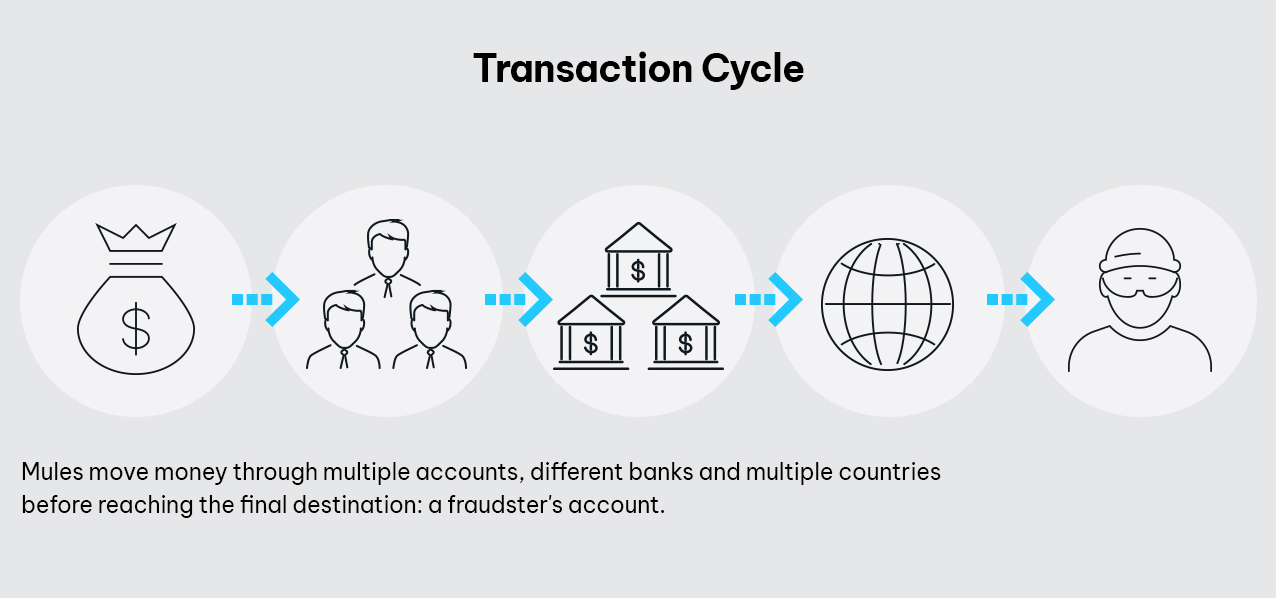

Further complicating detection is the fact that money mules themselves are difficult to identify. They often open bank accounts or facilitate transactions using fake identities or stolen personal information, making it hard for law enforcement to find them. Money mule transactions typically involve rapid movement of funds through multiple accounts, often through different banks and countries. This level of complexity makes it challenging for firms and law enforcement to track the flow of money and identify the ultimate beneficiaries.

Another challenge is the online and international nature of running money mules. Criminals can recruit money mules from around the world. When they cross international borders, this creates jurisdictional challenges for law enforcement agencies trying to apprehend suspects, as they must navigate different legal systems and work with international counterparts. However, stopping money mules is a high priority globally, as money mules undermine the financial integrity of the banking system that relies on trust and transparency. If money mule activities go unchecked, it erodes public trust in banks.

Money Mule Threat

Research in the 2023 Fraud Insights Report shows that 59% of new account fraud is mule related, and the majority of these accounts demonstrate mule characteristics within 45 days of account opening. However, in an instant payments environment where money transfers in seconds and regulators have proposed shifting liability for fraud reimbursement to banks, detecting money mules quickly is a revenue-protecting measure.

According to fraud expert Sean O’Malley, Research Director of Compliance, Fraud and Risk Management at IDC, the problems with money mules are pervasive enough that the Department of Justice, the Federal Bureau of Investigation (FBI), United States Postal Inspection Service and five other federal law enforcement agencies in the U.S. have a Money Mule Initiative to help identify the networks through which fraudsters obtain the proceeds of their fraud schemes. However, money mules are a global problem, not just a U.S. one.

What Countries Have the Biggest Problems with Money Mules?

A country’s financial infrastructure, technological development, law enforcement capabilities, and general awareness of scams involving money mules are all factors in how much activity they experience. This is just a sample of regions and countries that have established significant problems with money mule activities:

- Nigeria: The Nigerian prince scam is alive and well. Online scams in Nigeria are still flourishing, including the advance-fee fraud, aka 419 scams, and phishing attacks where money mules are recruited to move funds.

- Russia, Ukraine, South Africa, and India: Cybercriminal activity is widespread in these countries, specifically online fraud and cyberattacks, and cases where mules are moving money within criminal networks.

- United States and United Kingdom: the U.S. faces challenges related to money mule activity, due to extensive technology adoption and the size of its economy, while the K. reports money mule involvement in cases involving online fraud and financial scams.

Money mule activities can occur in any country, but criminals frequently target individuals and FIs in multiple jurisdictions. To effectively detect and prevent money mule operations, international collaboration between law enforcement agencies, regulatory bodies, and FIs in these and other countries is key. Together, these organizations across the globe can increase awareness, promote stronger regulations, and improve fraud detection.

What Measures Should Banks and Fintechs Put in Place to Stop Money Mules?

FIs play a crucial role in preventing financial crimes and detecting money mule activity. They can aid law enforcement and protect customers by detecting money mule transactions quickly. Some key measures to stop money mules that FIs can enact are:

Transaction Monitoring

An advanced transaction monitoring system will detect mule activity faster, and speedy identification in a faster payments landscape is important. Advanced transaction monitoring flags transactions that deviate from a customer’s typical behavior and identify patterns that might indicate money mule activities, such as sudden increases in incoming or outgoing transfers.

Risk Assessment and Profiling

Developing customer risk profiles based on factors such as transaction history, behavior, and source of funds will help FIs identify high-risk accounts targeted for money mule activities.

Robust Customer Due Diligence (CDD) and Know Your Customer (KYC) Processes:

Not only should FIs verify customer identities during onboarding, ongoing monitoring for unusual or suspicious activity is important as well. Customer information should be updated regularly to identify new activity patterns or changes in behavior that can indicate money mule activity on existing accounts.

Behavioral Analytics:

Use behavioral analytics to track and analyze customer transaction patterns more efficiently. Having the ability to identify deviations from typical behavior and flag transactions that can indicate money mule activity early on will protect both revenue and reputation.

Risk Assessment and Scoring:

Every customer has a risk score, but focusing on enhanced monitoring of high-risk customers or transactions can minimize losses. When choosing factors to assign customer risk scores, include transaction history and behavior—those are indicators of mule activity.

Employee Training:

Train bank staff to recognize common financial crimes, such as signs that an account might belong to a money mule. Ongoing education helps new and existing employees stay well-informed of emerging fraud trends.

Information Sharing

To stop money mules, every FI must establish protocols for identifying and reporting suspicious activities to relevant authorities such as law enforcement or regulatory agencies. Collaborate with law enforcement agencies to share information on potential money mule transactions and share information about known money mule frauds and tactics with other FIs and industry partners.

Customer Education

It’s not just good customer service—educating customers protects the firm, too. FIs can inform their customers about emerging threats through their website, brochures, targeted advertising campaigns, and employee interactions. Use a variety of online resources and communication channels to educate customers about the risks of becoming money mules, especially vulnerable customers like seniors who might be more trusting and have substantial amounts of money in retirement accounts. Not only will customers be armed with knowledge that can help them avoid becoming unwitting mules, but they can also assist the firm’s efforts to identify fraudulent activities before large amounts of money change hands.

Communications should also cover the risks and legal ramifications of becoming involved in money mule schemes. They might be unaware of the steep legal and financial consequences of participating in money mule activities, and this knowledge might deter someone from becoming a complicit money mule.

A multi-pronged approach combining advanced tech, employee training, customer education, and collaboration with law enforcement, regulatory bodies and others enables FIs to enhance their ability to detect and prevent money mule activities.

Collaboration is Key

Banks and other FIs can implement strategies that effectively detect and prevent money mule activities, including advanced fraud detection systems, transaction monitoring, customer due diligence, and customer and employee training. With law enforcement, regulatory bodies and other firms working together, FIs can stop money mules, minimize financial losses, and protect customers like Gloria Seim.

For more information on detecting money mules, go here.