Regulation Best Interest

| What happened? | In June 2019, the Securities and Exchange Commission (SEC) adopted a new standard of conduct for broker-dealers when recommending securities to retail customers. |

| When does it take effect? | June 30, 2020 |

| Who does the regulation effect? | SEC Registered Broker-Dealers and their associated persons. |

| When does Reg Best Interest Apply? | Regulation BI applies when a broker-dealer or a natural person who is an associated person of a broker-dealer makes a recommendation of any securities transaction or investment strategy involving securities (including account recommendations) to a retail customer. |

| What does it require entail? |

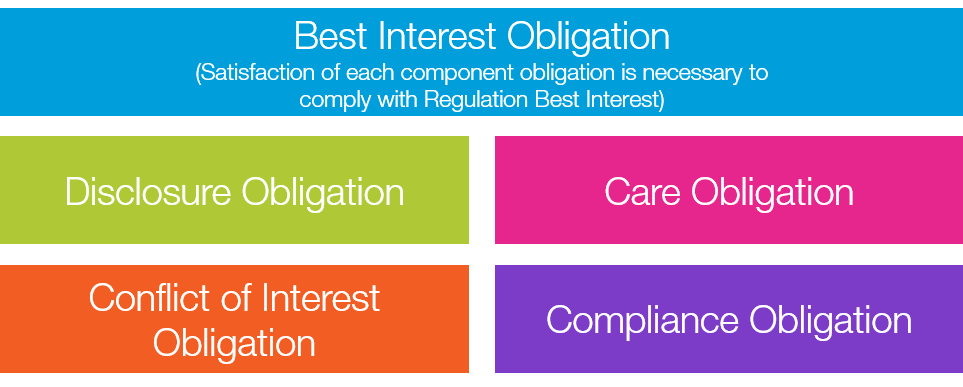

Best Interest Obligation

A Broker-Dealer, when making a recommendation of any securities transaction or investment strategy involving securities (including account recommendations) to a retail customer, shall act in the best interest of the retail customer at the time the recommendation is made, without placing the financial or other interest of the Broker-Dealer making the recommendation ahead of the interest of the retail customer.

Disclosure Obligation

The Broker-Dealer, prior to or at the time of the recommendation, provides the retail customer, in writing, full and fair disclosure of:

- All material facts relating to the scope and terms of the relationship with the retail customer, including:

(i) that the Broker-Dealer is acting as a broker, dealer, or an associated person of a broker or dealer with respect to the recommendation;

(ii) The material fees and costs that apply to the retail customer’s transactions, holdings, and accounts; and

(iii) The type and scope of services provided to the retail customer, including any material limitations on the securities or investment strategies involving securities that may be recommended to the retail customer; and - All material facts relating to conflicts of interest that are associated with the recommendation.

Care Obligation

The Broker-Dealer, in making the recommendation, exercises reasonable diligence, care, and skill to:

- Understand the potential risks, rewards, and costs associated with the recommendation, and have a reasonable basis to believe that the recommendation could be in the best interest of at least some retail customers;

- Have a reasonable basis to believe that the recommendation is in the best interest of a particular retail customer based on that retail customer’s investment profile and the potential risks, rewards, and costs associated with the recommendation and does not place the financial or other interest of the Broker-Dealer ahead of the interest of the retail customer;

- Have a reasonable basis to believe that a series of recommended transactions, even if in the retail customer’s best interest when viewed in isolation, is not excessive and is in the retail customer’s best interest when taken together in light of the retail customer’s investment profile and does not place the financial or other interest of the Broker-Dealer making the series of recommendations ahead of the interest of the retail customer.

Conflict of Interest Obligation

The Broker-Dealer establishes, maintains, and enforces written policies and procedures reasonably designed to:

- Identify and at a minimum disclose or eliminate, all conflicts of interest associated with such recommendations;

- Identify and mitigate any conflicts of interest associated with such recommendations that create an incentive for a natural person who is an associated person of a broker or dealer to place the interest of the Broker-Dealer, or such natural person ahead of the interest of the retail customer;

- (i) Identify and disclose any material limitations placed on the securities or investment strategies involving securities that may be recommended to a retail customer and any conflicts of interest associated with such limitations, in accordance with subparagraph (a)(2)(i), and

(ii) Prevent such limitations and associated conflicts of interest from causing the Broker-Dealer to make recommendations that place the interest of the Broker-Dealer ahead of the interest of the retail customer; and - Identify and eliminate any sales contests, sales quotas, bonuses, and non-cash compensation that are based on the sales of specific securities or specific types of securities within a limited period of time.

Compliance Obligation

This is the catch-all provision for firms. Under Reg BI Broker-Dealers are required to establish, maintain, and enforce written policies and procedures reasonably designed to achieve compliance with Regulation Best Interest.

Regulation BI Surveillance

The NICE Actimize automated Regulation BI Surveillance solution can assist in finding and reveiwing all alerts of trading risk associated with the disclosures and recommendations communication.

What is Regulation Best Interest?

Regulation BI applies when a broker-dealer or a natural person who is an associated person of a broker-dealer makes a recommendation of any securities transaction or investment strategy involving securities to a retail customer.

Watch the video on Regulation Best Interest and how to comply